Election row over VAT

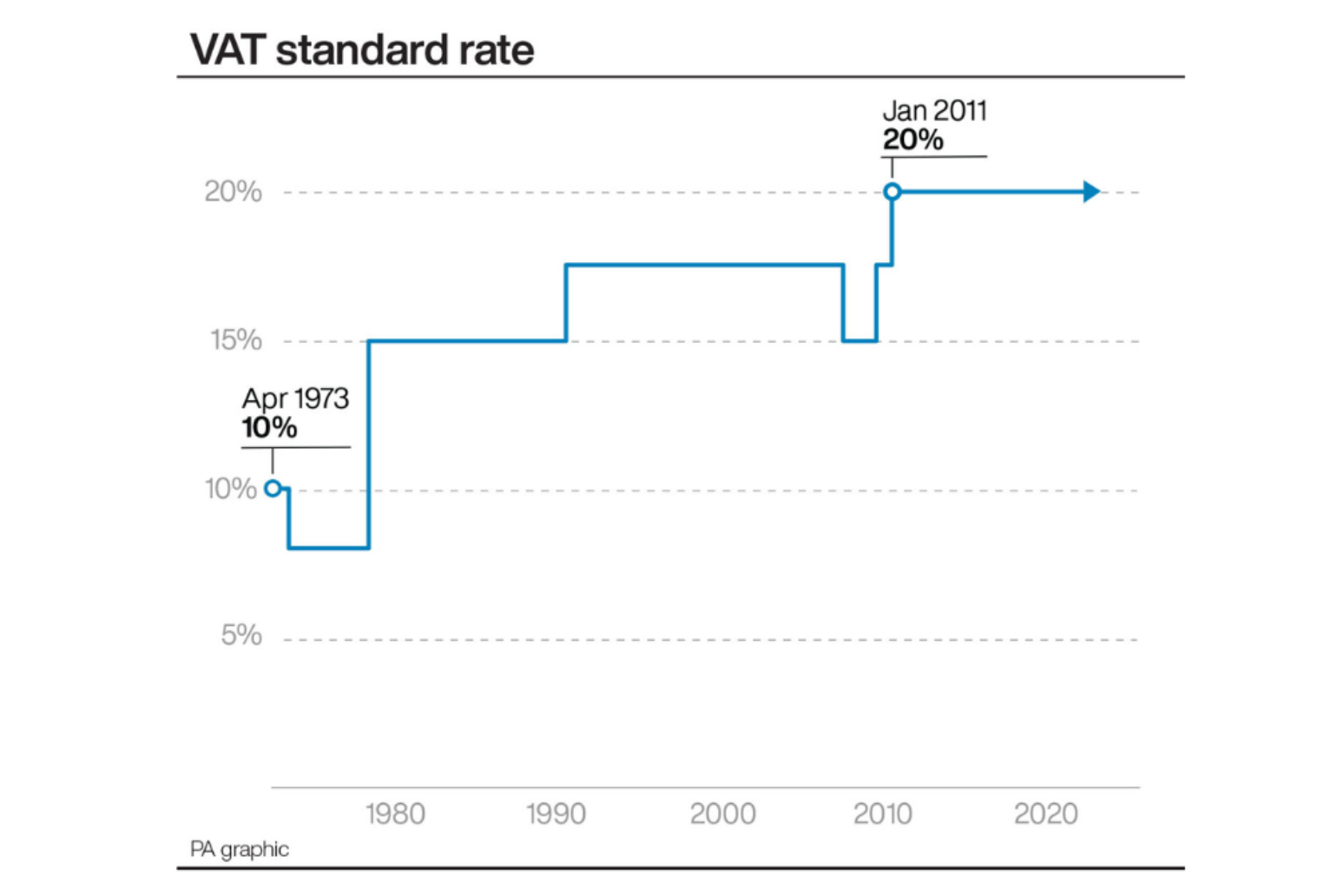

A General Election row has broken out over near-identical Conservative and Labour commitments not to raise VAT.

Both parties have pledged not to raise income tax, national insurance or VAT over recent days, should either of them form a government after polling day on July 4.

Setting out how his party would afford to lower the tax burden, Tory Chancellor Jeremy Hunt told BBC Breakfast that he would “want to avoid austerity-style cuts that we had after the financial crisis”.

Labour shadow Treasury minister Darren Jones denied his party has made a commitment not to raise VAT in response to similar pledges by his Conservative rivals, telling BBC Radio 4’s Today programme: “We’ve not been bounced into anything.”

The row began overnight as The Telegraph published an article by Mr Hunt which read: “A VAT increase will hammer families’ finances and push inflation back up, just when we have got it down to normal.”

He wrote: “Today we rule out increases in the rates of income tax and VAT. If Labour don’t do the same, we will be a bit closer to knowing how they will raise £2,094 in taxes from you.”

UK inflation slowed to 2.3% in April, the lowest level since July 2021 and near the Government’s 2% target, according to the latest figures.

The Conservative Party’s new poster bears the £2,094 figure and features a giant red piggy bank beneath the words: “If you think Labour will win, start saving…”

Shadow chancellor Rachel Reeves responded: “I want taxes on working people to be lower, not higher. That is why we opposed the increases to national insurance when Rishi Sunak put those forward as chancellor.”

Her party held a press conference in London on Wednesday, where Labour campaigners claimed the Conservatives have a financial black hole in their plans of £71 billion, made up of allegedly unfunded pledges.

Earlier in May, Mr Hunt claimed Labour’s pre-election campaign pledges would have left a £38.5 billion black hole in their budgets.

When asked about Ms Reeves’ firm commitment that Labour will not raise income tax, national insurance or VAT, Mr Hunt told BBC Breakfast: “She said that last night, but four times this week, her and Keir Starmer refused to rule out increasing VAT.

“What you have is a party that when it comes to the basic questions, cannot make up its mind.

“When you have, since 2010, an economy where we have created more jobs, attracted more investment, grown faster than nearly any other major European economy, it is a big risk, frankly, to hand that over to a party that can’t make up its mind on the basics.”

The Chancellor added: “I set out in the Budget very clear plans to improve the efficiency of public services, and I took a very difficult decision – I put £3.4 billion into improving the IT systems in the NHS.”

He said the move was “not something that’s a big vote-winner but it will make the NHS more efficient, meaning it can do more operations and means that we can run our public services more efficiently”.

Labour’s Mr Jones told the Today programme: “We’ve been very, very clear – even before the election was called – that we want the burden of taxes to come down on working people.

“That’s why we’ve supported the last two cuts to national insurance and why we’ve been consistent in saying we have no plans, no expectations to increase taxes on working people.”

When asked about the word “change”, used on Labour’s campaign material throughout the election campaign so far, he pointed to his party’s six-point “first steps” policy, planning reforms, and ambition to boost skills.

He said: “Of course, I would love to do lots of other things that cost lots of money, but I can’t because the Conservatives have crashed the economy, debt has gone through the roof, the cost of the national debt is a huge burden on the Treasury.”

Mr Jones claimed the UK’s economic woes began before 2022 when war broke out in Ukraine, during the austerity period which “failed to get growth back into the economy”.

Labour has not announced a plan to raise VAT at a general level, but the party has a much-publicised plan to extend VAT onto private school fees at the standard rate of 20%.

It has also proposed closing “loopholes” in the windfall tax on oil and gas companies and the Government’s plans to tax non-doms.

Both parties are making their General Election pledges against a challenging backdrop. The Institute for Fiscal Studies (IFS) said the next UK government will face the toughest fiscal inheritance for 70 years.

Published: by Radio NewsHub