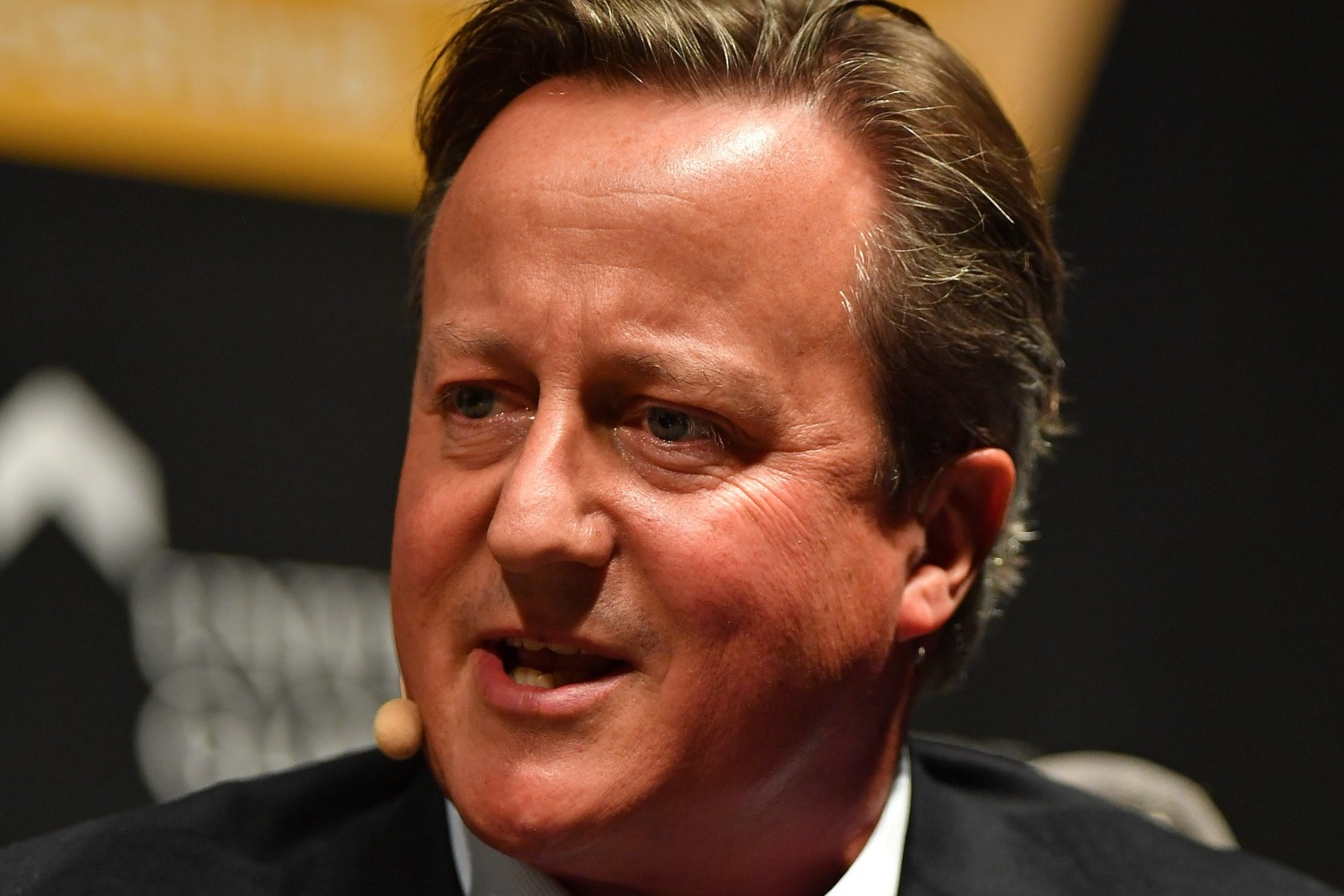

David Cameron’s Greensil Capital statement in full

Here is the full statement from David Cameron

“Since the collapse of Greensill Capital, many questions have been raised about my dealings with Lex Greensill in government, and my subsequent involvement with the company.

“I completely understand the public interest in this issue, given the impact of Greensill’s collapse on the hundreds of people who worked for the company and on other businesses and livelihoods. I feel desperately sorry for those affected.

“I also worry about the future of firms like GFG Alliance and the many jobs that could be on the line, which are linked to what has happened at Greensill.

“It’s important to understand that I was not on the Board of Greensill Capital, nor was I a member of the Risk or Credit Committees.

“I played no role in the decisions to extend credit, or the terms on which such credit was extended, to GFG or any other customer. But that is little comfort to the many who worry about the firm’s future and their jobs. They are very much in my thoughts throughout this difficult and uncertain period.

“Having said this, many of the allegations that have been made about these issues are not correct.

“Lex Greensill was brought in to work with the Government by the former Cabinet Secretary, Jeremy Heywood, in 2011. He was not a political appointee, but part of the Civil Service drive to improve government efficiency.

“In bringing him in, Jeremy was acting in good faith to solve a real problem – how to ensure companies in supply chains, particularly SMEs, could access low cost credit.

“The false impression has been created that Lex Greensill was a close member of my team, meeting with me on a regular basis. The truth is, I had very little to do with Lex Greensill at this stage – as I recall, I met him twice at most in the entirety of my time as Prime Minister.

“The Government supported his initiative to encourage large companies to use supply chain finance (SCF) to enable their suppliers to access low cost credit.

“I announced this initiative as Prime Minister in October 2012. I made it clear that the Government would play its part through the community pharmacy scheme, ensuring that thousands of pharmacies could get early payment to improve their access to credit and cash flow.

“This scheme has successfully reduced costs to the NHS and enabled many thousands of pharmacies to access early payments and low cost credit.

“The idea of my working for Greensill was never raised, or considered by me, until well after I left office.

“I took up the position as a part-time Senior Adviser to Greensill Capital in August 2018. This was shortly after General Atlantic, one of the most respected international backers of tech sector companies, invested in the company. Large financial institutions, like Credit Suisse, were helping to enable Greensill’s expansion.

“Likewise, well-known international blue-chip companies such as Airbus, Vodafone, Nissan, AstraZeneca, Ford and Oracle contracted and partnered with Greensill. The company had a strong board, with experienced figures from business, banking and finance.

“I was not a director of the company, and was not involved in the oversight of management, or the day to day running of the business. I was contracted to work for the company for 25 days per year (details of my other activities since leaving Downing Street are set out at the end of this statement).

“My remuneration was partly in the form of a grant of shares. Their value was nowhere near the amount speculated in the press.

“Part of my motivation for accepting the role was my desire to work for a UK-based, entrepreneurial, early stage finance and technology venture, rather than simply work with larger, more well-known financial institutions.

“I remain proud that during my time as Prime Minister the UK became a global centre of the new and emerging FinTech industry. Greensill was one of the fastest growing UK FinTech businesses. I was attracted by the solution it offered, supporting businesses to gain access to working capital.

“I later became an enthusiastic advocate for Greensill’s pay product, Earnd, which enabled employees to see and access their pay as they earn it, in real-time and, crucially, for free, with no charges or interest rates, rather than having to wait until the end of the month. This was, to my mind, an antidote to exploitative payday lending schemes.

“My responsibilities included providing geopolitical advice to the leadership, helping to win new business, speaking for the company at conferences and events, and helping with plans for international expansion.

“As part of my work, I assisted with presentations made by the company overseas, including in the US, Singapore, South Africa, Australia and the Gulf. While visiting the Kingdom of Saudi Arabia in January 2020 to advise on their forthcoming chairmanship of the G20, I also – with Lex Greensill – met with a range of business and political leaders, including Crown Prince Mohammed bin Salman.

“As the Softbank Vision Fund was by this time the largest investor in Greensill, the company was, in effect, part owned by the Public Investment Fund of Saudi Arabia (itself a major participant in the Vision Fund).

“Greensill planned to open a new regional office in Riyadh as part of its international expansion and I wanted to assist in this effort. While in Saudi Arabia, I took the opportunity to raise concerns about human rights, as I always did when meeting the Saudi leadership when I was Prime Minister.

“Like many businesses in 2020, Greensill – and many of its clients – was negatively affected by Covid. Companies facing challenging financial markets, especially ones whose activities impacted many other businesses, were encouraged to make representations to the Government.

“I made representations to the Treasury and others about the potential for the company to continue to play its part in extending credit to businesses, particularly via the Covid Corporate Financing Facility (CCFF). (The approach proposed by Greensill mirrored very closely action that had been taken during the financial crisis in 2008/09, when supply chain finance bonds were included in a similar financing facility).

“While I understand the concern about the ability of former ministers – and especially Prime Ministers – to access government decision makers and the sense, and reality, of ease of access and familiarity, I thought it was right for me to make representations on behalf of a company involved in financing a large number of UK firms. This was at a time of crisis for the UK economy, where everyone was looking for efficient ways to get money to businesses.

“It was also appropriate for the Treasury to consider these representations.

“Concern has been raised about the nature of my contact, via text message and e-mail. I understand that concern, but context is important: at that time the Government was – quite rightly – making rapid decisions about the best way to support the real economy and welcomed real time information and dialogue.

“It was a time of national crisis with fears about businesses’ access to credit. Greensill Capital wanted to offer a genuine and legitimate proposal to help with this.

“As part of my work for Greensill, I also discussed their solutions for supply chain finance and their pay product, Earnd, with others. This included various people to discuss the roll out of Earnd across the NHS, where it was being offered for free as part of Greensill’s Corporate Social Responsibility programme. Greensill met all costs themselves.

“I was attracted to Earnd as an exciting and innovative product with the real potential to help employees with their finances, not least being able to get paid at the end of their shift, rather than at the end of the month. I considered it important that Earnd would remain forever free to use for all workers and public sector employers.

“In my representations to government, I was breaking no codes of conduct and no government rules. The Registrar of Consultant Lobbyists has found that my activities did not fall within the criteria that require registration.

“Ultimately, the outcome of the discussions I encouraged about how Greensill’s proposals might be included in the Government’s CCFF initiative – and help in the wake of the Coronavirus crisis – was that they were not taken up.

“So, I complied with the rules and my interventions did not lead to a change in the Government’s approach to the CCFF.

“However, I have reflected on this at length. There are important lessons to be learnt. As a former Prime Minister, I accept that communications with government need to be done through only the most formal of channels, so there can be no room for misinterpretation.

“There have been various charges levelled against me these past weeks, mainly that I made representations to the Government on behalf of a company I worked for. I did.

“Not just because I thought it would benefit the company, but because I sincerely believed there would be a material benefit for UK businesses at a challenging time.

“That was, in large part, my reason for working for Greensill in the first place. I deeply regret that Greensill has gone into administration, but the central idea behind their key product –using modern technology and deep capital markets in order to help firms be better financed, to grow and create jobs — was a good one.

“My other work:

“My other principal activities since leaving 10 Downing Street have included:

– Writing and publishing my memoirs;

– Serving as President of Alzheimer’s Research UK, leading a major fundraising drive and chairing their early diagnosis project, Early Detection of Neurodegenerative diseases (EDoN);

– Chairing the Patrons of National Citizens Service (NCS), which I set up as Prime Minister;

– Co-chairing the Council on State Fragility with the former President of Liberia and former President of the African Development Bank;

– Sitting on the Board of ONE, the advocacy group for international development; and

– Co-chairing Pew Bertarelli Ocean Ambassadors, where we seek to build on the success of the UK’s Blue Belt, which helps protect our marine environments, and promote its goals around the world.

“I also back a range of charities and causes close to my and Samantha’s hearts, principally those associated with our Armed Forces and veterans, disabled and ill children, and Alzheimer’s. And I support a range of causes local to our home in Oxfordshire.

“My commercial interests include advising three other firms – Fiserv, Illumina and Afiniti – working in the areas of FinTech, BioTech and Artificial Intelligence respectively.

“I have also given a number of speeches, lectures and interviews through the Washington Speakers Bureau.

“David Cameron”

Published: by Radio NewsHub